Payment Methods for Invoicing Software

Invoicing software can offer their clients a range of invoice payment methods to get them paid faster for their offered services and attract customers for the business. You must select suitable and multiple payment methods for customers that work for your business model and meet your client’s requirements. You should also clearly list all the payment methods within the payment terms of your invoice document. So this way, you can easily avoid any confusion among your clients and avoid the slow down of the payment process.

There are multiple payment methods for businesses. And among all of them, consumers make the payment more with online payments and mobile payments. When offering the payment services to the customers, you should try to opt-out more as it increases more satisfaction by improving the customer satisfaction. It also takes less time and is a convenient way to increase your cash flow in the business.

Accepting the payments through phone, website, mobile app, or recurring payment schedule directly debits their customer’s bank account and is a more secure process than traditional cash and check process. And as technology continues to evolve and the opportunities for your business are also great. So, it would help if you tried to consider all the online and offline payment options which are easy, convenient, and seamless for customers to use.

There are multiple payment methods for your business which your business can accept to receive the payment from the customers for the paper invoices and online invoices.

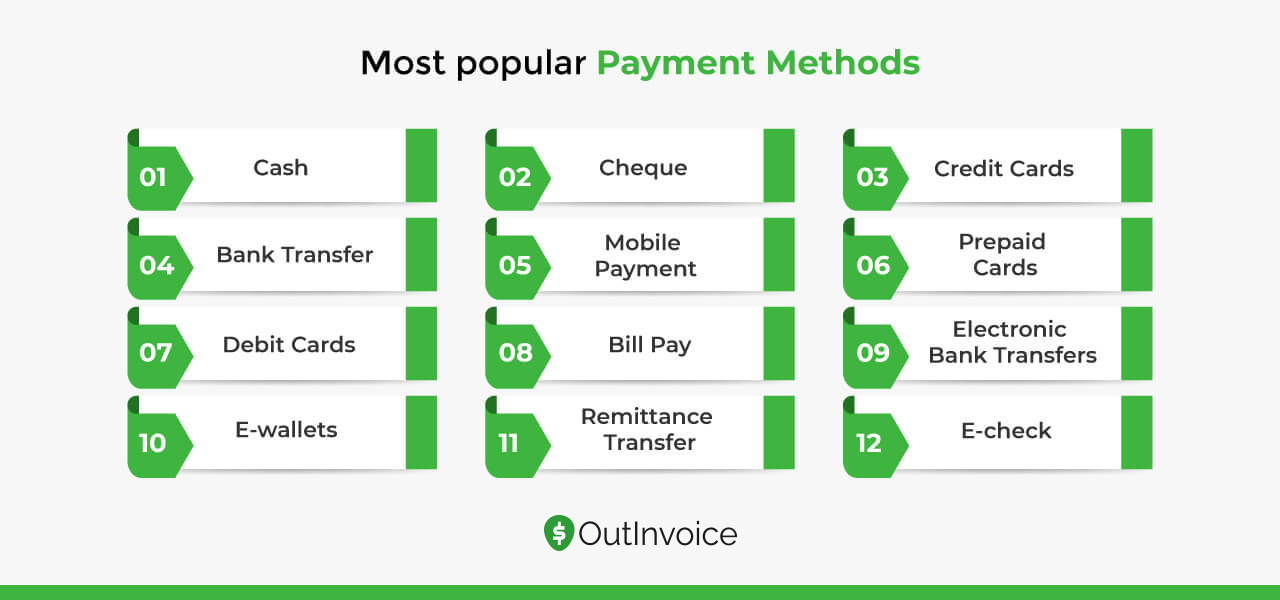

Top 12 Payment Methods for Invoicing Software

1. Cash

Cash is one of the standards and preferred payment methods for brick-and-mortar stores since there are no transaction fees or processing times associated with it. However, compared to other payment methods, cash is the traditional and the least secure payment method. It is vulnerable to theft and loss. Businesses which accept the cash are also more likely to have their tax audited because there’s a paper trail associated with cash.

As cash is one of the easiest and common forms of payment, many customers expect you to accept cash for the payment process. But many customers do not prefer cash to make large purchases with cash. They are usually preferred by those individuals who do not have a bank account or attempt to avoid reporting an income tax liability.

2. Cheque

A cheque is one of the most popular payment methods for small service businesses. They are cheap to accept and less vulnerable to theft than cash. But they are not a very secure payment method since you never know whether the bank associated with the cheque you received and whether you have sufficient funds to cover the payment. It can hurt your cash flow when your cash does bounce, and you might owe fees to your bank. A cheque also can take you a long time in your business days, and you might not get your money right away.

A cheque payment method can encourage customers to make more frequent or larger purchases and make large purchases. Also, you don’t have to store as much cash. However, you have to wait for the bank to process the check and put the money in your account, and there’s always a risk that someone will try to pay with the fake check or there’ll not be enough balance in the bank account.

3. Credit Cards

Credit cards are the most convenient payment method that offers a certain security level for businesses and clients. You’ll need a merchant account through a bank or a payment processing service provider. You also are charged with a transaction fee every time you accept a credit card payment from a customer. Credit cards can enable millions of users to make online purchases using the branded credit cards. Some multinational financial corporations support credit cards like Visa, MasterCard, and American Express.

But with a credit card, you don’t have to pay any extra charges for the transactions. They offer better consumer protection against fraud as compared with the other payment methods. It makes it easy for any purchaser to make purchases in stores or online. It gives you access to line a credit card issued by a bank.

4. Bank Transfer

You can also request direct bank transfers from your client’s bank account to your business bank account for the payment. You’ll need to provide some of your banking details, including your routing and account number, to your clients to accept bank transfers from your clients. Bank transfer is a simple process that is always quick and free to send. They are also more secure for accepting payments from your clients.

You can also quickly receive large payments without paying fees, and customers can easily make some large purchases. It is also a much quicker and convenient method than accepting cash or checks. With the bank transfer, you don’t have to worry about bad checks or fake cash. But non-business customers might not feel comfortable transferring money directly from their bank account to your businesses. Also, it is a long process as you’ll have to wait for the transaction to process before getting your payment.

5. Mobile Payment

Mobile payment is the payment made for any products and services through portable devices such as tablets or cell phones. They can lead more customers to make more frequent or larger purchases without the risk of fraud or theft. The most apparent benefit of mobile payment is that it eliminates the physical wallet and the risk that comes with it. They store your debit and credit card details so you can quickly pay for your purchase digitally using a mobile device. You can download a mobile wallet app and add your debit or credit card information stored securely. The most significant advantage of mobile payments is that they are secure, fast, and more convenient. They have the most enhanced security features and convenience.

They can be used in a “peer to peer” context or for paying that for the brick and mortar business. There are different payment methods like mobile browser-based payments, in-app payments, mobile or wireless credit card readers, and contactless mobile payment methods.

6. Prepaid Cards

The prepaid cards, including the prominent Green Dot Visa and the bluebird American Express Cards, are trendy in the market these days. Former and even present bank and credit union customers who have been hit with large overdraft or rejected check fees, as well as those who are paying high monthly account maintenance fees, have been flocking to prepaid cards in droves. But not all prepaid cards are created equally.

One of the main benefits of using prepaid cards is that we can’t overspend with them. And some of them even charge a fee if you try to purchase an amount more significant than what is on the charge card. So, they are perfect for the expenses like groceries, entertainment, dining out, and more. Gift cards also can be used similarly. However, it is more costly than the prepaid card.

7. Debit Cards

Debit cards have tons of advantages but also some definite downsides. Many people considered debit cards the best option for household purposes to live within a budget, as we have a fund limit. And debit cards directly draw the payment from the consumer’s bank account when it is used. They are also known as check cards or bank cards, can be used to buy any goods or services or get cash from the automated teller machine or through a merchant who’ll let you add an extra amount onto a purchase.

They eliminate the need to carry cash or physical checks to make the purchase, and they also can be used at ATMs to withdraw cash. They also have daily purchases with a debit card and can be used with or without a personal identification number.

8. Bill Pay

Nowadays, many financial institutions offer a free bill pay service, so one even bothers to write a check these days. We can use these free services to send over the money to our family members to pay up the bill, make donations to our church and different favorite charities, and more. We can use this service to pay bills using an app or a website. So instead of going with the traditional method, you can use a computer or smartphone to make the payment online instead of writing a check.

It’s effortless and straightforward and navigates through its online payment feature. It also allows you to manage your payments to various companies and all in one place. You need to provide some basic information about recipients to whom you owe money, whether it’s a bank or business. And, depending on the payee, the bank will use the amount drawn from the designated account to issue either an electronic payment or a paper check.

9. Electronic Bank Transfers

This is not a common type of method and goes by various names like direct transfer, Automated Clearing House(ACH), inter-institutional transfer, and more. This method goes by from the bank or credit union directly to a merchant. It is often considered billing, but the merchant initiates it but not by the financial institution.

They may seem very similar to online billing, but we can’t control anything about when the payment will arrive. However, set up electronic funds transfer (EFT) with that credit card or utility company. They will be responsible for drawing payment from the bank and credit union, as well as for late payments. The main challenge with electronic bank transfers is setting them up and then remembering them and making sure that you have sufficient funds in the bank to cover the charge.

10. E-wallets

E-wallets are the most popular alternative method for making online purchases, as they rely on a prepaid credit balance. Its utility is the same as some debit and credit cards. Electronic cards are used for transactions made online using electronic devices like computers or smartphones. They also need to be linked with the individual’s bank account to make the payments. Some common examples of E-wallets are Google Pay, Apple Pay, Venmo, and more.

It stores the different payment methods information of users for different payment modes on various websites and the other gift coupons and driver’s licenses. They can be used in different forms, like in smartphone apps or on desktops. And some apps charge you for doing the transaction, and the number of retailers that accept payments from an electronic wallet depends upon the wallet you choose. But still, there are some of the limitations like no internet will make things worse and the remote areas still relying on cash.

11. Remittance Transfer

Remittance can be defined as the personal money transfer to family, friends, or relatives. Simply it refers to the money transferred or sent from one party to another party. Any payment for an invoice or bill can also be called remittance. When someone sends or transfers money from one country to another for personal or business purposes, it is called remittance. Remittance also represents one of the largest income sources for low-income people and developing nations. The most common way of making a remittance is through a bank or money transfer service.

Remittance can increase the ease of credit constraints of unbanked households, and on the other hand, it can also be curtailed and can increase the consumption of goods with price raise, decrease the exports and appreciate the real exchange rate.

12. E-check

An electronic check or eCheck is the digital version of a traditional check. They are similar to paper checks, but they process faster. Money is electronically withdrawn from the payer’s check account, transferred into the ACH network, and then finally deposited into the checking account in eCheck. Technology allows the process to happen electronically rather than filling up the details manually in the electronic checking process, which saves time and effort and reduces paper waste. You can also convert the paper check received from the customer into an electronic transfer based on the information found on the paper.

E-checks are faster processing and won’t charge for the fee and labor reduction with customer payment options, but they have more fraud potential and create more errors and reduced float. They also have the environmental benefits and increased efficiency through it.

Conclusion

Choosing an appropriate tool for managing your business sales and keeping accurate records plays a considerable role. Most of the payment systems consist of hardware and software. The hardware can be your cash register, tablet, or any other small card reader that can work with various point of sale systems. And the POS software is the non-cash payment that can help you record, store and analyze your business information system.

You should maximize your payment option as much as possible for your invoicing software. The payment process will not be delayed if your customers get multiple payment methods, and the cash flow will increase as well. So for the payment method, from the traditional cash method to mobile payment. So you, the customer, can choose any method they are familiar and comfortable with.